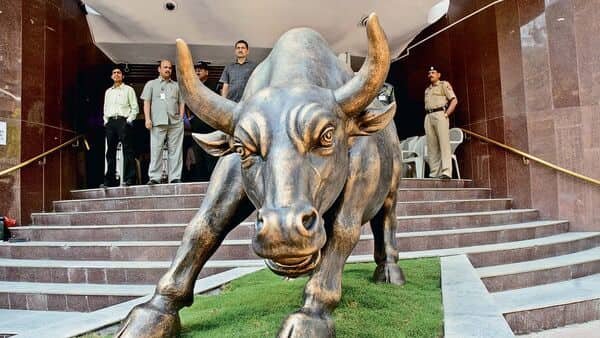

₹50 banking stock gives 50% return in YTD. Experts see 100% return in 2023

Multibagger stock for 2023: Banking stocks have delivered stellar return to its shareholders in 2022. As the year 2022 is about to end and the whole world is set to usher in new year 2023, stock market investors are busy scanning banking stocks that may given them stellar return or may be double their money in 2023. For such stock market investors, stock market experts have recommended Punjab National Bank (PNB) shares. They believe that banking stock may go up to ₹120 in 2023 as banking business and model is expected to remain intact in 2023 on hawkish interest rate regime.

“In hawkish interest rate regime, PNB and other PSU banks are expected to benefit from their retail business. After ease in dollar index, corporates who used to lend from overseas are now looking at Indian banks as overseas loans have become dearer. So, both retail and corporate lending business of the PSU banks are expected to take a leap in 2023 and hence PNB is expected to get benefit of this business scenario. PNB shares are bouncing back from the recent sell off and in the wake of renewed Covid-19 concern, it is expected to remain in the long rang of ₹36 to ₹60 apiece levels. So, if the stock falls from current levels, then ₹45 to ₹50 would be a good accumulation zone for long term positional investors,” said Anuj Gupta, Vice President — Research at IIFL Securities.

Speaking on PNB share price outlook, Sumeet Bagadia, Executive Director at Choice Broking said, “PNB shares are looking positive on hart pattern and any dip in the stock should be seen as buying opportunity by positional investors. The banking stock may give up to 40 per cent return in medium term whereas it may give to the tune of 20 per cent return in short term.”

Giving buy for long term tag to PNB shares, Anuj Gupta of IIFL Securities said, “After sharp correction in recent sessions, PNB stock has managed to breach the consolidation zone and is now poised for big upside as the stock is recovering from oversold zone. The stock has formed bullish engulf pattern on chart that signals sharp upside in near to medium term. One can buy the stock at around ₹50 apiece levels for one year target of ₹100 to ₹120 apiece levels maintaining stop loss at ₹36.”

In last one year, PNB share price has delivered to the tune of 50 per cent return to its shareholders, generating alpha return for its investors. In YTD time, 50-stock Nifty index has delivered 3.50 per cent return whereas BSE Sensex has surged around 3.60 per cent.

Disclaimer: The views and recommendations made above are those of individual analysts or broking companies, and not of Mint. We advise investors to check with certified experts before taking any investment decisions.

Know your inner investor

Do you have the nerves of steel or do you get insomniac over your investments? Let’s define your investment approach.

Take the test

Download Finplay News App to get Daily Market Updates.

More

Less