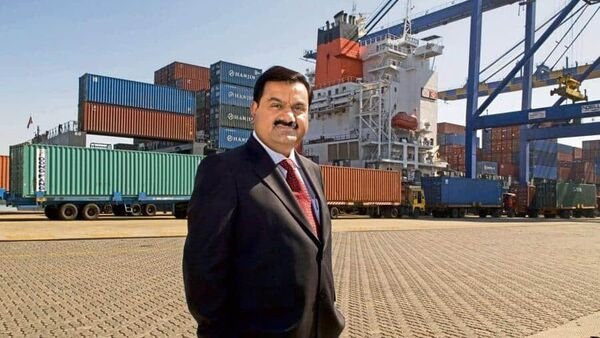

Adani Ports share price rises after Q4 results. Do you own?

Adani Ports share price has been in uptrend since early morning deals on Wednesday. Adani Ports share price today opened with an upside gap and went on to hit intraday high of ₹747.50 apiece levels, logging to the tune of 2 per cent intraday rise during early morning session. Adani Ports results 2023 was declared on Tuesday after the market hours, which means Dalal Street has cheered Adani Ports Q4 results.

According to stock market experts, this rise in Adani Ports share price today can be attributed to the quarterly results of the company, which sys that Adani group company has logged 5.1 per cent YoY growth in Q4FY23. However, they said that Adani Ports share price is facing hurdle at around ₹750 apiece levels and hence one should wait for the correction as the positive trigger can be short lived.

Adani Ports share price target

Speaking on the reason for Adani Ports share price rally, Avinash Gorakshkar, Head of Research at Profitmart Securities said, “Adani Ports share price is rising today due to its positive Q4 results announced on Tuesday. In this quarterly results, Adani Ports had reported revenue growth of 40 per cent to ₹5,797 crore compared to ₹4,140.8 crore in Q4FY22.”

Advising Adani Ports shareholders to hold the stock for more gains, Sumeet Bagadia, Executive Director at Choice Broking said, Adani Ports share has immediate support placed at ₹710 and there can be some profit booking at current levels as the stock is facing hurdle at ₹750 levels. However, on breaching this hurdle, it may go up to ₹800 apiece levels. So, high risk investors can start accumulating this Adani share from now maintaining buy on dips whereas those who believe in safe investment should wait for correction and take position in ₹700 to ₹710 apiece range maintaining stop loss at ₹670 per share levels.”

Adani Ports and Special Economic Zone (ASPEZ) owners earned a consolidated net profit of ₹1,158.88 crore in the fourth quarter of FY23, registering a growth of 5.1 per cent as against ₹1,102.61 crore a year ago same quarter. Adani Ports concluded its FY23 fiscal with the highest-ever cargo volumes, record investment, and maintaining its net debt to EBITDA ratio well within the guided range.

However, the company’s revenue witnessed a much stronger growth of 40 per cent to ₹5,797 crore in Q4FY23, compared to ₹4,140.8 crore.

Disclaimer: The views and recommendations given in this article are those of individual analysts. These do not represent the views of Mint. We advise investors to check with certified experts before taking any investment decisions.

Know your inner investor

Do you have the nerves of steel or do you get insomniac over your investments? Let’s define your investment approach.

Take the test

Download Finplay News App to get Daily Market Updates.

More

Less

Updated: 31 May 2023, 12:03 PM IST