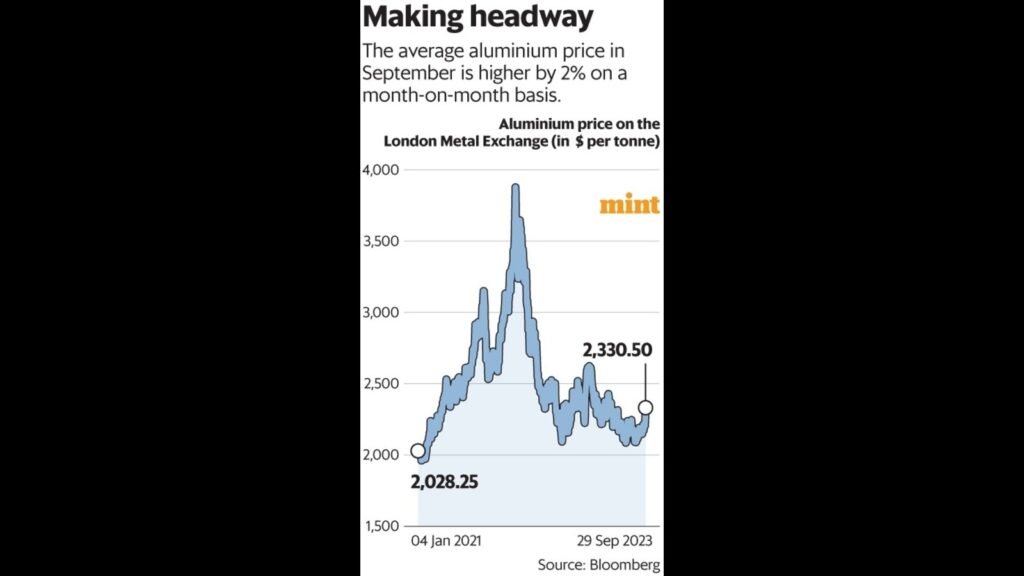

Aluminium prices up in Sep, but not enough to delight investors

Aluminium price on the London Metal Exchange is gradually gaining strength. The average price in September was roughly $2185 per tonne, up by 2.2% versus the average seen in August. Do note that the average price in the September quarter is still 4.4% lower sequentially. This suggests that there is a long way to go for aluminium prices to gather adequate momentum.

However, it is likely that the downside risk to aluminium price is low this time around. Aluminium prices are holding up at higher levels versus previous downturns, aided by two factors, said Satyadeep Jain, an analyst at Ambit Capital. One, higher energy prices would mean higher costs in this downturn versus the previous. The production of aluminium is power intensive and hence energy price is a key determinant here. Two, the tighter demand-supply equation in this downturn versus 2015-16, given the lack of new aluminum supply, has led to higher spreads, said Jain.

Even so, there are not enough tailwinds for the aluminium price to shoot up as there is less demand. China is a key market for metals and the gradual reopening of the economy is crucial for the overall demand to pick up pace. The production in China continues to inch up owing to a “resumption of a few of its capacities,” said analysts at Nuvama Research in a 20 September report. This could further lift production in the rest of 2023, which would keep the global market in surplus, and aluminium prices under pressure, said the brokerage.

In this backdrop, shares of key aluminium producers such as Hindalco Industries Ltd and Vedanta Ltd could get a boost. In 2023 so far, shares of Hindalco are up by only 4%. while that of Vedanta are down by nearly 28%. Last week, Vedanta announced the demerger of its existing businesses into six listed entities, which will cater to separate commodities such as aluminium, steel & iron ore and zinc & copper. This demerger plan would unlock value for the company and accelerate growth in each vertical.

In FY23, Vedanta’s aluminium division clocked production of 2.3 million tonnes per annum. It is on track to increase production to 3 million tonnes per annum. On the margin front, the operationalization of captive mines would lower costs.

For Hindalco, the Chakla mine is likely to be fully operational by FY26, which is a plus for margin. To be sure, investor sentiment would get a boost only when aluminium price regains its lost lustre.

“Exciting news! Mint is now on WhatsApp Channels 🚀 Subscribe today by clicking the link and stay updated with the latest financial insights!” Click here!

Download Finplay News App to get Daily Market Updates.

More

Less

Updated: 02 Oct 2023, 08:16 PM IST