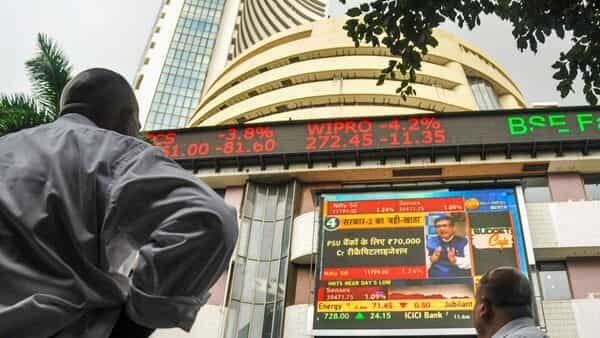

BSE-listed firms m-cap at lowest level since July 2022; investors lose ₹10.43 lakh cr in 7 days selloff

All it took is a total of seven trading days to push the BSE-listed equities market cap below ₹260 lakh crore. Billions of wealth have been eroded since February 17th, taking the m-cap to its lowest in eight months. Blame it all on the lack of driving factors in the domestic market, while global peers along with fears of more rate hikes and dangling inflation prospectus take a jab at Indian equities. While the Adani saga continues with relentless selling.

On Monday, bears continued to dominate the Indian market with Sensex and Nifty 50 slipping below 59,300 and 17,400 levels. A broad-based selloff was seen across indices with small-cap stocks taking a massive beating. Banking stocks outperformed benchmarks but could not offset the selling pressure due to steep selloffs in IT, auto, and healthcare stocks. Huge profit booking in major Tata Group stocks also weighed on sentiment.

This led Sensex to dip by 175.58 points or 0.30% to end at 59,288.35. Meanwhile, Nifty 50 dropped by 73.10 points or 0.42% to finish at 17,392.70.

Tata Group stocks were top losers on Monday. Tata Steel led the bear market by slipping nearly 3.4%, while Tata Motors and heavyweight TCS shed 2.3% and 2.01%. While the majority of Adani stocks also stayed in the red, taking the group’s overall market value to below ₹7 lakh crore.

On Monday alone, the m-cap of BSE-listed firms dropped by over ₹2.12 lakh crore.

M-cap as of February 27th stood at over ₹257.88 lakh crore, which is the lowest level since July 2022. The last time markets were in the green was on February 16th, when the m-cap of BSE equities was around ₹268.31 lakh crore.

That being said, in seven trading sessions, investors’ wealth of nearly ₹10.43 lakh crore.

In these seven days, Sensex has plummeted by over 2,031 points or 3.3%, while Nifty 50 has shed over 643 points or 3.6%.

Meanwhile, investors have lost around ₹33.37 lakh crore of wealth from the record-high market cap of ₹291.25 lakh crore which was witnessed on December 14 of last year on BSE.

M-cap of BSE firms closed at ₹270.23 lakh crore in January month, while the overall December 2022 month finished with a valuation of ₹282.38 lakh crore.

The m-cap has been above ₹266.59 lakh crore from July 2022. The valuation closed at around ₹243.74 lakh crore in June last year.

Vinod Nair, Head of Research at Geojit Financial Services said, “Bears continued to wreak havoc in the domestic market as the latest data releases from the US heightened the existing worries of aggressive rate hikes.”

He added, “The personal consumption expenditure in the US, which is Fed’s key monitorable of inflation, increased in January, pressuring investors to stay away from equities markets. The US dollar index surpassed 105, adding further pressure on the INR.”

Know your inner investor

Do you have the nerves of steel or do you get insomniac over your investments? Let’s define your investment approach.

Take the test

Download Finplay News App to get Daily Market Updates.

More

Less