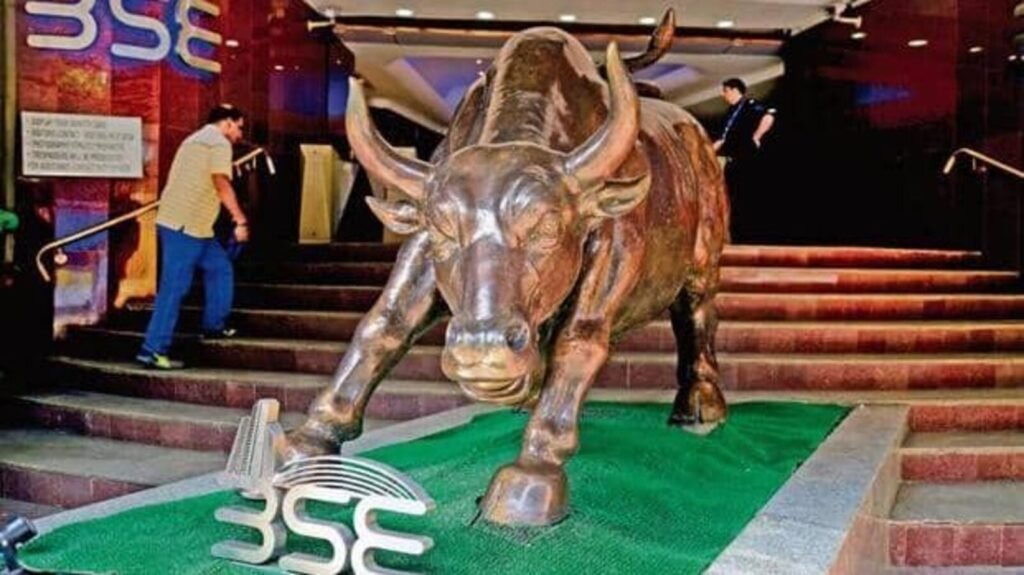

BSE share price vs MCX share price: Which exchange stock to buy amid bull run?

MCX and BSE shares have witnessed a stellar rally this year on the back of strong fundamentals, robust trading volumes and optimistic outlook for earnings

BSE, a universal exchange, facilitates trading in equities, derivatives, commodities, and currencies. On the other hand, MCX, as a prominent commodity trading platform, commands a substantial market share in commodity derivatives trading.

Year-to-date (YTD), BSE share price has witnessed an impressive surge of over 330%, underscoring the robust investor confidence in the exchange. Similarly, MCX shares have demonstrated substantial growth, registering an 85% increase during the same period.

Analysts maintain a bullish outlook on both stocks, anticipating a robust performance in the future driven by the distinctive catalysts associated with each exchange.

Q2 Results

BSE reported a net profit of ₹118.41 crore in the July-September quarter of FY24, registering more than a four-fold jump from ₹29.39 crore in the year-ago quarter.

The stock exchange reported its highest quarterly revenue of ₹367 crore in Q2FY24, compared to ₹239.8 crore in Q2FY23, reflecting a growth of 53%. Operating EBITDA jumped to ₹141.7 crore from ₹13.4 crore, while EBITDA margin improved significantly to 45% from 7% in the corresponding quarter of last fiscal year.

Read here: BSE Q2 FY24 results: profit rise by 256.4% YoY

On the other hand, MCX reported a net loss of ₹19.07 crore in the second quarter of FY24 due to the contribution made to the Settlement Guarantee Fund (SGF).

The company’s revenue from operations increased during the quarter by 30% to ₹165.11 crore from ₹127.4 crore in the corresponding quarter of the previous fiscal.

Read here: MCX Q2 results: Net loss at ₹19 crore, revenue rises 30%

BSE Shares Outlook

BSE is consolidating well on its newly found traction in the equity index options segment, post the introduction of different expiry days compared to NSE. The strong performance can be seen in terms of volume growth, price hikes as well as introduction of new products in the derivatives segment, ICICI Securities said.

BSE’s average daily turnover in the equity cash segment reached ₹5,922 crore in Q2FY24, compared to ₹4,740 crore in the corresponding quarter last year. In its equity derivatives segment, BSE achieved a milestone by trading more than 27 crore contracts, representing a notional turnover of ₹177 lakh crore on November 10, 2023, as per the company’s earnings report.

Also Read: BSE stock hits new record high, up 471% from March low; is it still a ‘buy’?

The brokerage had upgraded the stock in July 2023, based on the right to win in the large equity derivative market of India and downgraded the stock to ADD in October 2023, considering substantial stock price movement which is now well capturing the near term earnings opportunity.

The brokerage firm has now downgrade its rating on BSE to ‘Hold’, basis 40x FY25E core earnings (ex-investment income) with estimates factoring in derivatives volumes in FY25 to be 30.3% of FY25E NSE ADTV and pricing in FY25E to be 88% of FY23 NSE levels.

It has raised the target price on the stock to ₹2,411 per share from ₹1,799 earlier.

ICICI Securities expects BSE’s options turnover to increase 9% every month from October 2023. This would translate to ₹22 lakh crore ADTV for FY24E and exit ADTV of ₹50 lakh crore in March 2024.

HDFC Securities said that BSE’s market share gain in the derivatives segment was quite impressive, and the recent pricing reset improved revenue visibility with better profitability.

(Exciting news! Mint is now on WhatsApp Channels Subscribe today by clicking the link and stay updated with the latest financial insights! Click here!)

“The new BSE is well-placed to get a share of the large options market in India, powered by the new generation of option traders,” said the domestic brokerage firm.

It pointed out that the SENSEX contract has been successful and has reached a market share of 25%, while the overall notional market share is 12%. The launch of the weekly BANKEX contract with a Monday expiry will trigger the next phase of market share gain for BSE, it said.

MCX Shares Outlook

MCX India, the largest commodity bourse in the country, has transitioned to a new technology platform while it has been witnessing robust volume growth in commodity options trading. This, along with other catalysts, have increased analysts’ earnings expectations.

MCX’s commodity options have grown almost 14x since June 2021. During the quarter ended September 2023, MCX’s average daily turnover of futures and options rose by 25.5% to reach ₹1.05 lakh crore, compared to the previous quarter’s ₹83,341 crore.

In October, MCX went live with its new commodity derivatives platform (CDP). The exchange’s operations have been smooth post the transition.

Also Read: Tech transition ups the ante for commodity exchange MCX

MCX expects good volumes in future basis volatility in commodity markets. TCS’ platform has 1-year warranty with no fee to be paid till September 2024 by MCX to TCS. Amortisation of software cost may be over 5-8 years.

Moreover, MCX said it plans to launch new products in the next few months and has applied for approvals and renewals with SEBI for select products. New products in the pipeline include – steel TMT options, gold monthly options, cotton contract and electricity contracts.

Also Read: MCX share price extends rally to hit record high; UBS lifts target on near-term growth drivers, sees 25% more upside

Analysts are bullish on MCX stock as they believe the company boasts several near- to medium-term drivers of volume growth. These include new product launches, continued volatility in key commodity prices and a rise in retail participation in the options market.

Additionally, analysts also do not expect any impact from competition on MCX’s volumes, as similar products are currently available on other exchanges.

“MCX India has managed to transition to a new software platform while volumes have surged in options. The outlook is favourable, considering high volatility. We now factor in ₹250 billion and ₹1,474 billion of futures and options ADTV in FY25. We envisage option premium to be 1.7% of notional turnover in FY25E versus 1.84% in Q2FY24,” ICICI Securities said.

ICICI Securities upgraded MCX to ‘Add’ from ‘Reduce’ and raised the target price to ₹2,864 per share from ₹1,521 earlier.

At 1:30 pm, BSE share price was trading 1.13% higher at ₹2,348.25 apiece, while MCX shares traded 4.32% higher at ₹2,894.45 apiece on the NSE.

Catch Live Market Updates here

Disclaimer: The views and recommendations made above are those of individual analysts or broking companies, and not of Mint. We advise investors to check with certified experts before taking any investment decisions.

Milestone Alert!Livemint tops charts as the fastest growing news website in the world 🌏 Click here to know more.

Download Finplay News App to get Daily Market Updates.

More

Less

Updated: 15 Nov 2023, 01:36 PM IST