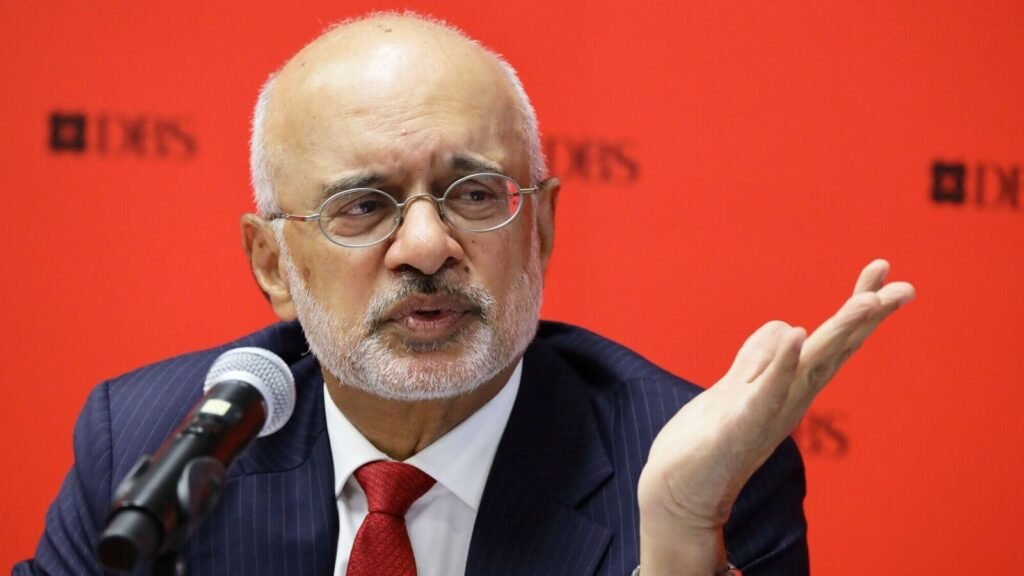

DBS board holds CEO Piyush Gupta accountable for digital disruptions, cuts pay by 30%

Singapore’s DBS Group on Wednesday announced to cut the variable pay of its management, including CEO Piyush Gupta, holding them accountable for the digital disruptions suffered in 2023. CEO Piyush Gupta will get a 30% pay cut this year which amounts to $3.08 million, it said in its quarterly earning statement.

DBS said collectively the group management committee took a 21% reduction in their variable pay.

“The Board determined that the variable compensation for the CEO and other members of the Group Management Committee should be cut to hold them accountable for the series of digital disruptions during the year (2023),” DBS said.

The company faced multiple digital disruptions in 2023, which forced the Singaporean banking regulator Monetary Authority of Singapore (MAS) to bar DBS from any new acquisitions for a period of 6 months. DBS was additionally instructed to temporarily halt any non-critical IT modifications for a period of six months and was prohibited from downsizing its branch and ATM networks in Singapore.

Piyush Gupta emphasized on Wednesday that the senior management team of the company has demonstrated accountability for the sequence of service interruptions experienced last year.

“We announced that we’re taking accountability at the senior management, starting with me, but also the rest of my senior management team. I think that’s a good element of governance,” Gupta said.

“If you can establish accountability and figure that people take responsibility for making fixes, that’s a good place to start. We’ve been able to demonstrate that and that’s obviously despite a record profit year,” he told reporters.

DBS Bank beat expectations to report 2% rise in net profits

In the October-December quarter, the DBS Group reported a 2% rise in its net profit to 2.39 billion Singaporean dollars from 2.34 billion Singaporean dollars posted during the same quarter last fiscal. The company maintains guidance for net interest income for 2024 at around last year’s levels.

“While interest rates are expected to soften and geopolitical tensions persist, our franchise strengths will put us in good stead to sustain our performance in the coming year,” Gupta said in a statement.

Here’s your comprehensive 3-minute summary of all the things Finance Minister Nirmala Sitharaman said in her Budget speech: Click to download!

Download Finplay News App to get Daily Market Updates & Live Business News.

More

Less

Published: 07 Feb 2024, 10:38 PM IST