Deficit rainfall trips tractor segment, gets auto sector worked up

The progress in the recovery of rural demand this year depends to a good extent on how the monsoon pans out. But rainfall has been subdued in August. This has a significant bearing on the automobile segment, especially the companies that sell vehicles that are more skewed towards the rural economy. Tractors are a case in point.

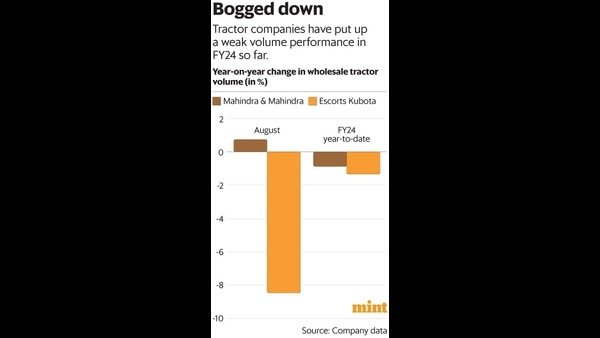

In August, Mahindra & Mahindra Ltd (M&M)’s tractor volume grew by merely 1% year-on-year to 21,676 units. Escorts Kubota Ltd saw a drop in its tractor volume of 8.5% y-o-y to 5,593 units. In the first five months of FY24, the tractor volume of both companies has dropped by about 1% each.

“Given the rainfall deficit of 33% in August, we see a downside risk to our expectation of low single-digit growth for the tractor industry. One needs to closely track if monsoon catches up in September and the kharif sowing progress. A disappointment here may necessitate revision of our volume estimates,” said Aniket Mhatre, an analyst at HDFC Securities.

Apart from tractors, the auto companies that mainly cater to the demand for entry-level vehicles would also be adversely impacted owing to the weak monsoons. In the two-wheeler industry, Hero MotoCorp Ltd derives a significant chunk of its volume from the mass market. In the passenger vehicle segment, Maruti Suzuki India Ltd falls into this category. In August, Maruti’s volume in the mini and compact segment fell by nearly 10%.

However, Maruti’s efforts to expand its offerings in the premium market could hold it in good stead. The sharp 118% growth in its utility vehicles drove the company’s total volume at 189,082 units in August, ahead of analysts’ estimates. Its new launches such as Fronx and Grand Vitara are garnering a good response from customers. Unsurprisingly, Maruti’s shares hit a new 52-week high of ₹10,397.95 apiece on Friday.

Further, it helps that the supply chain constraints are easing in the passenger vehicle industry. This has aided in the reduction of the waiting period for key models. For instance, analysts at Nomura Financial Advisory and Securities (India) note that the Thar model of M&M had a waiting period of 12 to 16 weeks in July. This has fallen to 8 to 12 weeks in August, according to Nomura.

Overall, more clarity regarding the demand environment will emerge with the release of the retail volume data by Federation of Automobile Dealers Association. On the brighter side, the festival season could bring cheer on the volume front.

Download Finplay News App to get Daily Market Updates.

More

Less

Updated: 03 Sep 2023, 10:20 PM IST