Earnings in focus for Coforge with stake sale overhang out of the way

The wait is over for investors in the Coforge Ltd stock. On Thursday, the midcap inform-ation technology (IT) services comp-any said existing promoter HULST B.V. (Baring Private Equity Asia) sold its entire 26.63% stake in Coforge.

This development allays some investor concerns and is sentimentally positive. As analysts from Nuv-ama Research point out, “Over the last two years, Barings had been paring its stake in the company, as it realised handsome returns on its investment—which had created an overhang on the stock—of an impending block every few months. This stake sale removes that overhang.” Now, Coforge becomes a free-float professionally-managed company.

With this, investors need to shift focus on its earnings growth. In June quarter (Q1FY24), Coforge reported sequential constant currency revenue growth of 2.7%. For FY24, it targets revenue growth in the 13-16% range in constant currency terms.

“While the company’s comment-ary on deal pipeline and demand environment in Q2 is awaited, as of now, its revenue growth target of FY24 seems ambitious. There could be execution related challenges,” Omkar Tanksale, senior research analyst, Axis Securities, said.

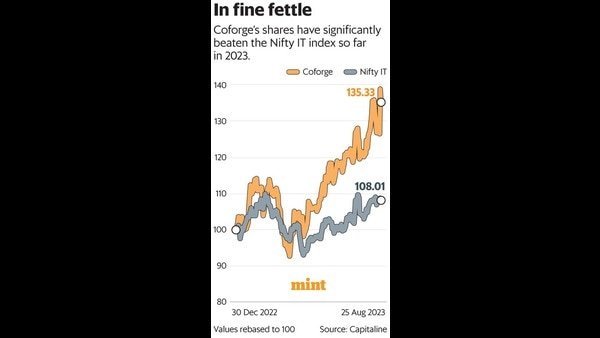

In Q1, Coforge repo-rted a record order intake of $531 million, which includes a $300 million total contract value deal with an existing European banking and financial services (BFS) client and a $65 million deal with a BFS client. Its executable order book over the next 12 months stood at $897 million, up 19% year-on-year. The deal win trajectory is healthy considering overall uncertain demand for the IT sector and provides revenue growth visibility to some extent. But, Coforge could face increased competition from large-cap IT companies in BFSI segment, which is a key revenue generator. In Q1, factors such as wage hike and increased visa costs, among others, adversely impacted the company’s margin but the management is of the view there will be a recovery. In FY24, the company expects gross margin to increase by 50 basis points and adjusted Ebitda margin to be at around 18.3%. Meanwhile, so far in 2023, the Coforge stock has rallied by 35%, sharply outperforming the Nifty IT index. Unsurprisingly, valuations have become pricey. At FY25 price-to-earnings, the stock is trading at a multiple of nearly 27 times, a premium to tier-1 IT peers, showed Bloomberg data. However, Coforge is still trading at a discount to some midcap IT competitors such as L&T Technology Services Ltd and Persistent Systems Ltd. This valuation gap could narrow further depending on the company’s earnings growth performance in FY24.

.

Download Finplay News App to get Daily Market Updates.

More

Less

Updated: 28 Aug 2023, 12:18 AM IST