Global bonds are set to erase 2023 gains

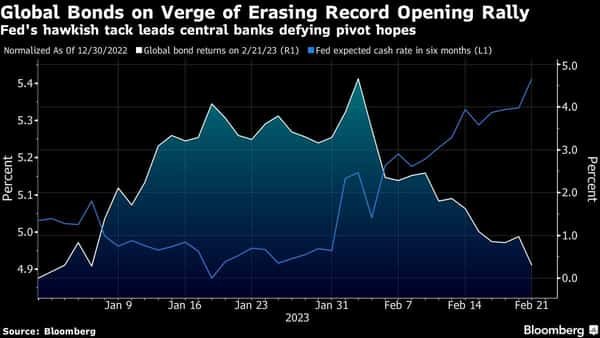

Global bonds are poised to erase all of the gains they made in their best start to a year on record.

Fixed-income assets have gone into reverse as central banks around the world have stood by their intention to keep raising interest rates to tame inflation, defying bond bulls who piled into debt last month, betting on a pivot. US Treasuries tumbled Tuesday on further signs the world’s biggest economy is proving resilient despite almost a year of policy tightening.

While US government debt rebounded slightly Wednesday, the gain was pared in the wake of an afternoon release of the minutes from the Federal Reserve’s Jan. 31-Feb. 1 gathering.

The records showed that Fed officials continued to anticipate that further increases in borrowing costs would be necessary to bring inflation down to their 2% target.

“Global bonds can decline further in coming weeks due to the ongoing recalibration of the economic outlook and the Fed’s reaction function,” said Damien McColough, head of fixed-income research at Westpac Banking Corp. in Sydney. The “higher for longer narrative” for central bank interest rates is the driver, he said.

A Bloomberg index of global bonds has dropped 2.9% this month through Tuesday, unwinding almost all of its 3.3% surge in January, which was the best first month of a year since the gauge was introduced in 1990.

Boosting Bets

Having surged the most since September on Tuesday, the Treasury 10-year yield was about 3 basis point lower at about 3.92% in mid-afternoon trading in New York as fresh signs of demand appeared for the sort of interest payments that haven’t been available for most of the past decade.

“The current trend is higher rates across the curve. Full stop,” Dennis DeBusschere, the founder of 22V Research said in a note.

Interest-rate strategists at Bank of America raised their 2023 forecasts for two-year and five-year US Treasury yields based on “economic re-acceleration and inflation risks.”

As of Tuesday’s close, US Treasuries lost about 0.14% this year, according to a Bloomberg index. As of Feb. 2, a day before the release of well above-forecast January US job creation data, the US government debt was up just over 3% for the year.

“Investors are likely to buy back in once they judge yields are high enough to justify that move, given data indicating strong flows into bonds as an asset class,” said James Wilson, a senior fund manager in Melbourne at Jamieson Coote Bonds. “We are dipping our toes into the markets at these very attractive valuations.”

“The US 10-year yield looks set for a move above 4%,” Westpac’s McColough said. “My sense is that there will still be a strong yield-seeking bid when volatility settles down a bit, likely at around the 4.15%-to-4.20% range.”

New Zealand’s central bank on Wednesday was the latest to warn against the dangers of elevated inflation. Policy makers hiked their benchmark by half a point as economists forecast to 4.75%, the highest in the developed world.

Download Finplay News App to get Daily Market Updates & Live Business News.

More

Less