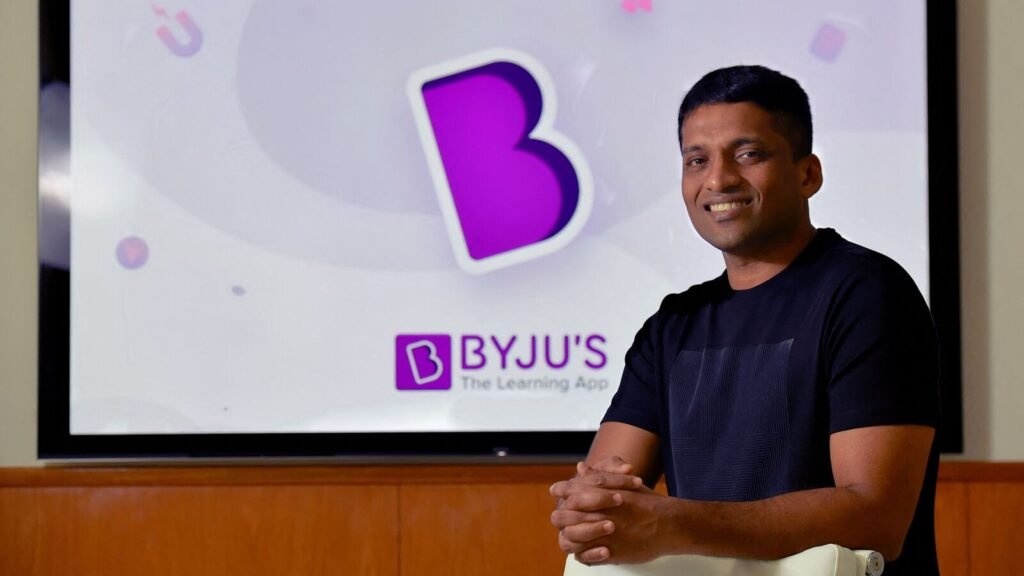

Gloves on: Not taking allegations lying down, remain CEO, says Byju Raveendran

Byju Raveendran, chief executive officer of India’s once-most valued startup, Byju’s, assured employees that he retains control of the company he founded and that he plans to challenge shareholders who have voted to oust him.

“Contrary to what you may have read in the media, I continue to remain CEO, the management remains unchanged, and the board remains the same,” Raveendran said in a letter to employees on Saturday. “I am not taking any of these allegations lying down and will challenge these illegal and prejudicial actions.”

Byju’s has deemed invalid the extraordinary emergency meeting held on Friday, where shareholders also voted for the company’s board to be reconstituted. The meeting was attended by at least two dozen investors, including Prosus Ventures, General Atlantic, Chan Zuckerberg Initiative, and Peak XV Partners.

These developments further underline the turbulent relationship between Byju’s and its investors after the troubled edtech company announced a $200-million rights issue that stands to dilute the shareholding of non-participating investors by 99%.

On Thursday, these investors, with support from Tiger Global and Owl Ventures, filed a petition before the National Company Law Tribunal against Byju’s $200-million rights issue, alleged suppression of investor rights, outstanding governance, financial mismanagement and other compliance issues at Byju’s.

They also called for a reconstitution of the board of directors so that it is no longer controlled by the founders of (Byju’s parent company Think and Learn Pvt. Ltd), and a change in leadership of the company.

“To reemphasize, the rumours of my firing have been greatly exaggerated and highly inaccurate,” Raveendran said in his letter, adding that “claims made by a small group of select minority shareholders that they have unanimously passed the resolution in the EGM is completely wrong.”

He added that only 35 out of 170 shareholders, or about 45% of shareholders, voted in favour of the resolutions at the meeting, calling the EGM a ’farce’.

Netherlands-based Prosus is the second-largest stakeholder in Byju’s with more than a 9% share. Prosus, General Atlantic, Peak XV and Chan Zuckerberg Initiative hold a combined 30% stake in Think & Learn. Raveendran and his family hold about 23%.

Raveendran argued that the EGM lacked a ’proper quorum’ that requires the presence of at least one founder-director as per the company’s Articles of Association. He added that there were other “numerous procedural irregularities and deficiencies” that invalidated the resolutions passed by “a select, narrow group of shareholders”.

Byju’s rights issue is planned at a pre-money valuation of $20 million, a far cry from the company’s peak valuation of $22 billion a few years ago, when Raveendran was regarded as the Indian entrepreneurial ecosystem’s poster boy.

Meanwhile, according to Byju’s, the Karnataka High Court has granted an interim relief for the company stating that any decisions made at the EGM would not be given effect until resolution.

Unlock a world of Benefits! From insightful newsletters to real-time stock tracking, breaking news and a personalized newsfeed – it’s all here, just a click away! Login Now!

Download Finplay News App to get Daily Market Updates & Live Business News.

More

Less

Published: 24 Feb 2024, 09:19 PM IST