JK Cement investors may need to tone down high expectations

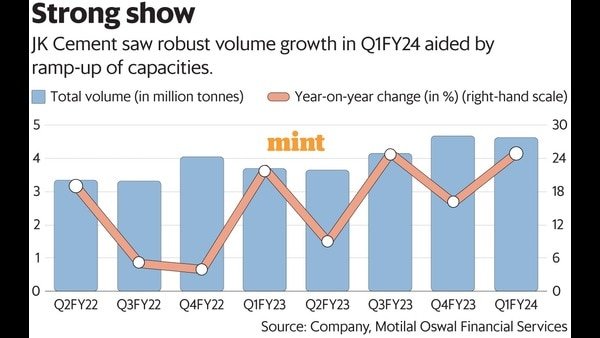

Shares of JK Cement Ltd have fallen by nearly 5% since it announced its June quarter results (Q1FY24). This is even though it clocked an impressive 25% year-on-year volume growth aided by ramp-up of capacity at its Panna and Hamirpur units. What is more, the management is confident of seeing 15-20% volume growth in FY24 even as Q2 is likely to see some moderation in demand due to seasonality.

Further, the company’s grey cement capacity expansion plans remain on track. Among the key highlights, the company’s new plants in central India have achieved 75% capacity utilization level in a short span. But JK Cement’s net debt rose marginally to ₹3,031 crore in Q1FY24 from ₹2,910 crore in Q4FY23 mainly due to additional borrowing for the Ujjain project. While the management believes that net debt has peaked, analysts feel that an update/timeline on de-leveraging would be helpful.

“Considering the capital expenditure (capex) lined-up for FY24 and FY25, we don’t expect faster debt reduction, thus weighing on free cash flow generation,” said Mangesh Bhadang, senior vice-president, Centrum Broking Ltd. For FY24, the company is targeting capex of ₹1,200-1,400 crore and ₹700-800 crore for FY25.

“Profitability is a concern for JK Cement. Our estimates show that its grey cement segment did an Ebitda/tonne of ₹800 in Q1FY24, which is one of the lowest among peers. Increasing competition in its key market of central India where it is adding capacity, could be a challenge,” Bhadang added.

Meanwhile, developments in the paint business, though still at a nascent stage, are crucial given that competition is heating up in the paints sector. In the earnings call, the management said for paints business, JK Cement is targeting revenue of ₹120-150 crore in FY24 and ₹300 crore in FY25. In Q1FY24, its paints segment’s revenue was ₹25 crore, while Ebitda loss was ₹2 crore.

An aggressive capex commitment for the paints business going ahead could hurt investor sentiment, caution analysts. After falling by 14%in 2022, the recovery so far in 2023 has been slow with the midcap stock up by 6%. “We like JK Cement’s presence and new expansion in the regions having favourable demand and pricing, but we feel the current EV/tonne limits any further upside in the stock,” said an Incred Research Services Pvt. Ltd report on 17 August. EV is enterprise value. At FY25 EV/Ebitda the stock is trading at a multiple of 12.75 times, showed Bloomberg data. For now, triggers for large upsides in the stock appear few and far between.

Download Finplay News App to get Daily Market Updates.

More

Less

Updated: 21 Aug 2023, 09:46 PM IST