New aircraft order likely to firm IndiGo’s position in long run

InterGlobe Aviation Ltd is getting ready to capture the growth opportunity. Its plans to expand its fleet come at a time when there are concerns about the supply scenario in the Indian aviation market. This makes the announcement sentimentally positive for the stock, which hit a new 52-week high of ₹2,490 apiece on Tuesday.

InterGlobe runs IndiGo airline, India’s largest by market share. The airline has placed an order for 500 aircraft with Airbus, taking IndiGo’s order book close to 1,000 aircraft. As on FY23-end, IndiGo’s fleet strength was 304. But the order does not change anything meaningfully in near-to-medium term as deliveries are scheduled between 2030 and 2035. “While new aircraft order makes business future proof from a long-term perspective, right now, it is difficult to gauge how things pan out beyond 2030,” said Jinesh Joshi, an analyst at Prabhudas Lilladher.

The order placed with Airbus consists of A320 planes, which are fuel efficient, which is a plus for profitability. “IndiGo’s consistent approach to aircraft management has given it rich dividend by continuously being able to sustain cycles in terms of lowest cost structure and cash accretion,” said analysts at ICICI Securities in a 20 June report.

But amid the ongoing global engine crisis, fleet expansion trajectory needs closer tracking. In the March quarter (Q4FY23) earnings call, IndiGo said number of grounded aircraft is in the high 30s due to shortage of spare engines. Such issues mean higher expenses without incremental revenue. Note that faulty engines supplied by Pratt & Whitney’s International Aero Engines, LLC led to Go First filing voluntary insolvency resolution process with National Company Law Tribunal.

“IndiGo is managing the engine crisis better than its peers,” says Joshi. Engine selection for the 500 aircraft is pending. In FY24, IndiGo aims to add 40-50 planes (on a net basis). It helps that demand is still ahead of supply, which aids the yield, a measure of pricing. IndiGo’s yield stood at ₹4.9 in Q4.

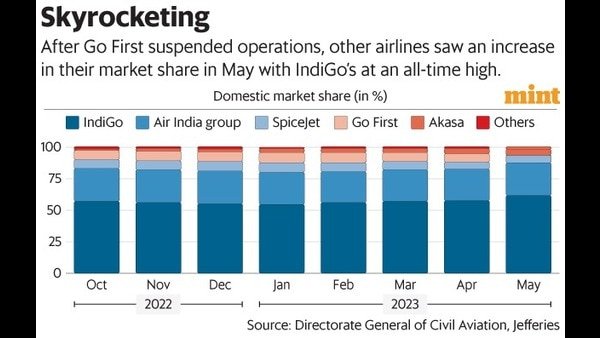

Currently, IndiGo finds itself in an envious position. With Go First suspending operations, other airlines gained market share in May with IndiGo’s touching an all-time high at 61.4%. Airfares got a boost, too. Robust demand and relatively softer aviation turbine fuel prices augur well for margins.

So far in 2023, IndiGo’s shares have risen by a stellar 21%, factoring the brighter picture adequately. However, competitive intensity is rising and the potential stake sale by IndiGo’s co-founder Rakesh Gangwal is an overhang.

Know your inner investor

Do you have the nerves of steel or do you get insomniac over your investments? Let’s define your investment approach.

Take the test

Download Finplay News App to get Daily Market Updates.

More

Less

Updated: 20 Jun 2023, 09:32 PM IST