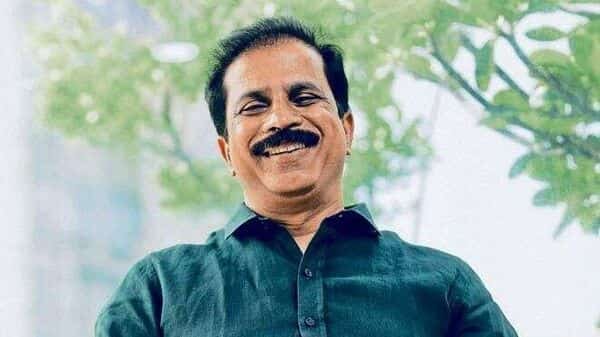

Porinju Veliyath buys stake in Nomura-owned stock that has risen 50% in 6 months

Porinju Veliyath portfolio: Ace Indian stock market investor Porinju Veliyath has bought fresh stake in Max India Ltd. As per the NSE bulk deals details available on the official NSE website, czar of small-cap stock has bought 2.30 lakh company shares in a bulk deal executed on 15th December 2022. The market magnet bought these 2.30 lakh shares paying ₹100.31 apiece. This means the Indian investor and fund manager has invested ₹2,30,71,300 or ₹2.30 crore in the small-cap stock.

Max India share price history

Max India shares are one of those shares on Dalal Street that have delivered stellar return to its positional shareholders. In last one month, this small-cap Porinju Veliyath stock has risen from around ₹95 to ₹102.50 apiece levels, delivering around 7.50 per cent return to its shareholders. In last six months, this small-cap stock has risen from around ₹68 to ₹102.50 levels, ascending more than 50 per cent in this time. In year-to-date (YTD) time, Max India share price has surged from ₹75 to ₹102.50 per share levels, appreciating around 35 per cent in 2022. In last one year, it has delivered to the tune of 33 per cent return to its positional investors.

FII shareholding in Max India

As per the Max India Ltd shareholding pattern for July to September 2022 quarter, FPIs (Foreign Portfolio Investors) hold 30,59,984 company shares, which is 7.11 per cent of total paid up capital of the company. Out of these 7.11 per cent FPI-owned shares, Nomura Singapore owns 6,40,000 shares or 1.49 per cent stake in the company. Apart from Nomura, Habrok India Master hedge fund owns 8,16,738 Max India shares that are 1.90 per cent of total paid up capital of the company. TVF Fund operated by TCF Capital, which has a history of giving absolute risk-adjusted return, has also made investment in this new Porinju Veliyath portfolio stock. TVF Fund holds 10,60,955 shares or 2.47 per cent stake in the company.

The stock is owned by ace investor Narayan Krishnamurthy Iyer as well. The ace investor holds 5.25 lakh company shares, which is around 1.22 per cent of total paid up capital of the company.

Know your inner investor

Do you have the nerves of steel or do you get insomniac over your investments? Let’s define your investment approach.

Take the test

Download Finplay News App to get Daily Market Updates.

More

Less