Q3 Results Today: Zomato, Apollo, Biocon, Torrent Power, Honeywell among 272 others to post earnings on February 8

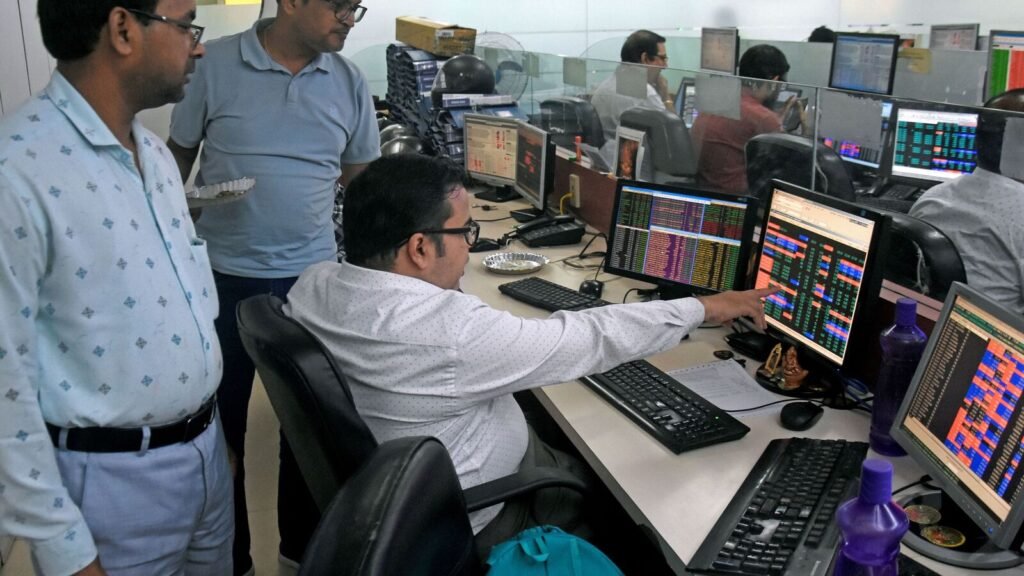

Q3 Results 2024: As we pass the halfway point of the earnings season, anticipation builds for the quarterly financial announcements of nearly 272 companies scheduled for Thursday, February 8. Among the highly anticipated reports, Dalal Street is particularly focused on the performance of key players including Zomato Ltd, Biocon Ltd, Thermax Ltd, Apollo Hospital Enterprises Ltd 3M India Ltd, and more.

The BSE Sensex was down 34 points at 72,152, while the Nifty 50 gained 1.1 points at 21,930.5 on February 7.

The mixed global sentiments led to a mild opening for our domestic market, wherein the benchmark index started mildly but soon after gained a gradual momentum and kept surging northwards. The broad-based buying traction levitated the undertone, which certainly was seen in the technical chart structure for Nifty. Amidst a favorable sentiment, the index managed to maintain a positive stature and settled the day a tad above 21900, procuring 0.72 percent to bull’s kitty, Sameet Chavan, Head Research, Technical and Derivative – Angel One, said.

“Technically, there has been insignificant development with minor alterations on a broader view of the index. However, sectoral rotation is quite evident, keeping the play in markets. The chart structure construes a range-bound activity to continue, with a strong nearby resistance at the 22000 mark, followed by 22100. And a decisive breakthrough could only trigger the next leg of rally in the Nifty50 index. On the contrary, 21800-21750 remains the intermediate support, while the 20 DEMA placed around 21650 is to be seen as a sacrosanct support zone for the comparable period, Chavan added.

Approximately 272 companies will release their Q3 quarter results today — February 8

Biocon Ltd, Bombay Dyeing & Mfg Co Ltd, Escorts Kubota Ltd, Grasim Industries Ltd, Hindustan Construction Co Ltd, Honeywell Automation India Ltd, IRCON International Ltd, Jai Corp Ltd, Jai Mata Glass Ltd, JK Lakshmi Cement Ltd, JSL Industries Ltd, Kajal Synthetics & Silk Mills Ltd, Kanpur Plastipack Ltd, Kilitch Drugs (India) Ltd, Mahan Industries Ltd, MSTC Ltd, Mukand Ltd, NCC Limited, Neelkanth Ltd, Orient Paper & Industries Ltd, Ramco Industries Ltd, Rane Holdings Ltd, Ratnamani Metals & Tubes Ltd, RDB Realty & Infrastructure Ltd, Schneider Electric Infrastructure Ltd, Surya Roshni Ltd, Tiger Logistics (India) Ltd, Torrent Power Ltd, Weizmann Ltd, and Zomato Ltd cover a range of sectors including pharmaceuticals, infrastructure, manufacturing, and logistics.

Zomato Q3 Results: In the second quarter, Zomato demonstrated significant sequential growth in profits, reaching ₹36 crore. Meanwhile, revenue from operations experienced a remarkable year-on-year surge of 71 percent, totaling ₹2,848 crore.

According to brokerage firm Kotak Institutional Equities, the revenue is likely to grow 61 percent year-on-year (YoY). “ We expect 3QFY24 revenue growth to come in at 61% YoY, driven by 45% YoY growth in food delivery revenues (29% YoY growth in GMV and 70 bps yoy take rate expansion), 89% YoY growth in Hyperpure revenues and 106% YoY growth in Blinkit revenues. Our food delivery GMV growth assumption implies 8% sequential growth,” it said.

Here’s your comprehensive 3-minute summary of all the things Finance Minister Nirmala Sitharaman said in her Budget speech: Click to download!

Download Finplay News App to get Daily Market Updates & Live Business News.

More

Less

Published: 08 Feb 2024, 08:08 AM IST