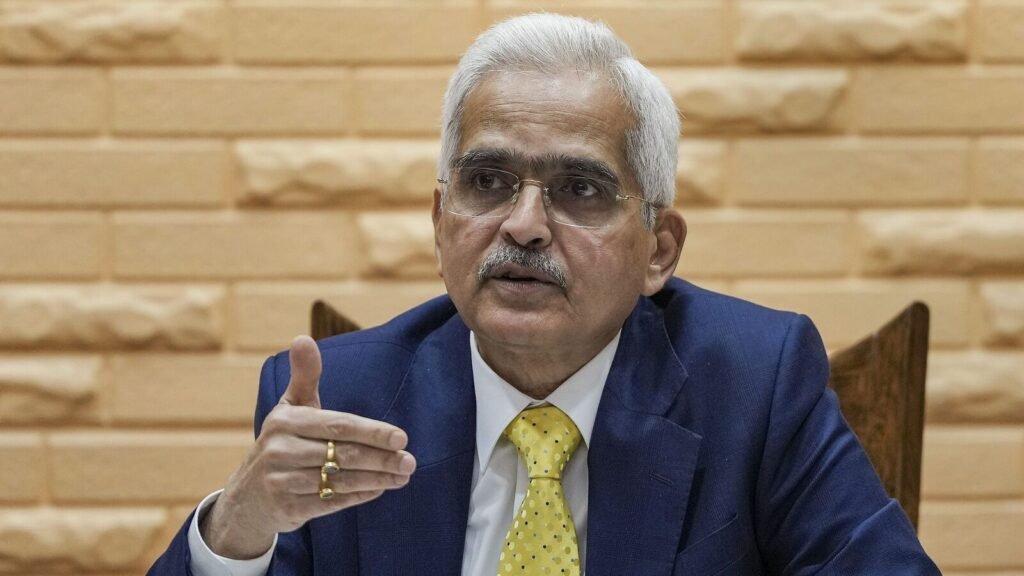

RBI Governor Shaktikanta Das says ‘hardly any room’ to review regulatory action against Paytm Payments Bank

Reserve Bank of India (RBI) Governor Shaktikanta Das on Monday made it clear that there was “hardly any room” to review the action taken against Paytm Payments Bank. Governor Das said that the central bank’s decision came after a comprehensive assessment and was taken in the interest of the consumers.

Last month, the Reserve Bank of India (RBI) issued a directive to Paytm affiliate Paytm Payments Bank, mandating the cessation of a significant portion of its operations by February 29. This includes discontinuing services related to deposits, credit offerings, and its widely-used digital wallets, citing ongoing issues of non-compliance.

The Reserve Bank of India may soon release FAQs (Frequently Asked Questions) on all aspects of the decision against Paytm Payments Bank, which will clarify any confusions in the minds of consumers about the RBI’s decision against the fintech startup.

While underscoring the RBI’s support of the fintech industry, the RBI Governor asserted its dedication to safeguarding both customer interests and maintaining financial stability.

₹2,000 crore raised during IPO may come to Paytm’s rescue

The regulatory crackdown by RBI is expected to be expensive for Paytm, which is rapidly losing its users. While CEO Vijay Shekhar Sharma is engaged in high-level discussions to minimize the damage, the embattled startup may get some breathing space from the ₹2,000 crore raised during the initial public offering (IPO) in 2021.

As per Moneycontrol, Paytm raised ₹8,300 crore from its IPO in November 2021 and utilized ₹4,300 for business growth. Moreover, the company used ₹1,819.4 crore for general corporate purposes and ₹2,000 crore was set aside for inorganic initiatives, such as acquisitions, strategic partnerships, and investing.

The report said that this ₹2,000 crore is lying unutilized in the bank account of Paytm and may come in handy at times of crisis.

Paytm is considering multiple options at the moment including continuing its payment service as a third-party payment app (TPAP). The proposal may allow it to provide the Paytm customers with continued access to its UPI services.

Here’s your comprehensive 3-minute summary of all the things Finance Minister Nirmala Sitharaman said in her Budget speech: Click to download!

Download Finplay News App to get Daily Market Updates & Live Business News.

More

Less

Published: 12 Feb 2024, 04:20 PM IST