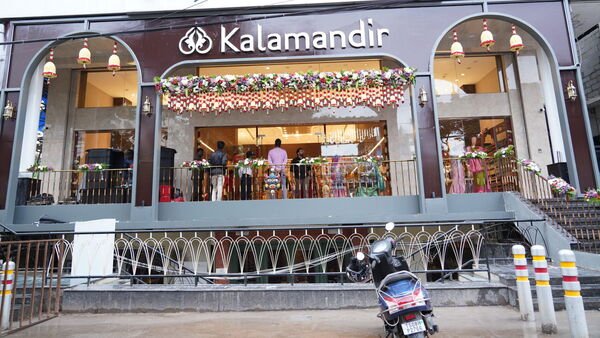

Sai Silks Kalamandir IPO: Sai Silks IPO subscribed 5% on day 1 so far; retail portion booked 9%

Sai Silks Kalamandir subscription status: Sai Silks Kalamandir IPO has been subscribed 5% on day 1 so far. Sai Silks Kalamandir IPO opens for subscription today (Wednesday, September 20), and will close on Friday, September 22.

Sai Silks IPO’s retail investors portion was subscribed 9%, NII portion was subscribed 2%, and Qualified Institutional Buyers (QIB) portion was did not see any subscription so far.

Sai Silks Kalamandir IPO has received bids for 18,60,054 shares against 3,84,86,309 shares on offer, at 13:54 IST, according to data from the BSE.

Sai Silks IPO retail investors’ portion received bids for 16,89,539 shares against 1,94,75,200 shares on offer for this segment.

Sai Silks Kalamandir IPO’s non-institutional investors’ portion received bids for 1,70,515 shares against 83,46,515 on offer for this segment.

Also Read: Sai Silks Kalamandir IPO opens today: GMP, review, other key details. Should you subscribe?

Sai Silks Kalamandir IPO details

Sai Silks IPO comprises a fresh issuance of ₹600 crore worth of shares and an offer for sale (OFS) of up to 2.70 crore equity shares by promoter and promter group.

The company intends to use the net proceeds from the offering to finance capital expenditures for the establishment of 30 additional stores and two warehouses, as well as for working capital needs, debt repayment, and general corporate purposes.

Motilal Oswal Investment Advisors Ltd, HDFC Bank Ltd, Nuvama Wealth Management Ltd are the book running lead managers to the offer. Bigshare Services Private Ltd is the offer’s registrar.

In the year 2005, Sai Silk was incorporated. They rank among South India’s top 10 ethnic clothing merchants in terms of revenue and profit after tax for the fiscal years FY21, FY22, and FY23. Lehengas, men’s ethnic wear, children’s ethnic wear, as well as value fashion products that include fusion wear and western wear for women, men, and children are just a few of the products that Sai Silk offers. These products are suitable for weddings, parties, as well as occasional and daily wear.

Sai Silk IPO dates

Sai Silks Kalamandir IPO share allotment will tentatively take place on Wednesday, September 27. Those allotted shares will get them in their Demat accounts on Tuesday, October 3. The refund process for those who did not get shares will begin on Friday, September 29. Sai Silks IPO shares will be listed on NSE and BSE on Wednesday, October 4.

Sai Silks Kalamandir IPO GMP today

Sai Silks IPO GMP today or grey market premium is +7 similar to the previous two trading session. This indicates Sai Silks Kalamandir share price were trading at a premium of ₹7 in the grey market on Wednesday, according to topsharebrokers.com

Considering the upper end of the IPO price band and the current premium in the grey market, the estimated listing price of Sai Silks Kalamandir share price is ₹229 apiece, which is 3.15% higher than the IPO price of ₹222.

Sai Silks Kalamandir IPO GMP on Sunday was ₹0, which meant shares were trading at their issue price of ₹222 with no premium or discount in the grey market according to topsharebrokers.com

‘Grey market premium’ indicates investors’ readiness to pay more than the issue price.

Also Read: Sai Silks Kalamandir IPO: Sai Silks IPO raises ₹360.30 crore from anchor investors; details here

Download Finplay News App to get Daily Market Updates.

More

Less

Updated: 20 Sep 2023, 02:06 PM IST