Sanjiv Bhasin of IIFL Securities’ contrarian view on when markets will revive

Sanjiv Bhasin’s stock market strategy: After climbing to record highs on 1st December 2022, key benchmark indices have been falling continuously. Nifty 50 and BSE Sensex has dipped to the tune of 3.50 per cent after hitting its record highs respectively. However, things got further worsened when fear of rising Covid-19 cases started hitting the headlines. On account of fresh Covid concerns, Indian stock market went through another wave of sell off from 15th December 202 and on further deep on Friday in the week gone by.

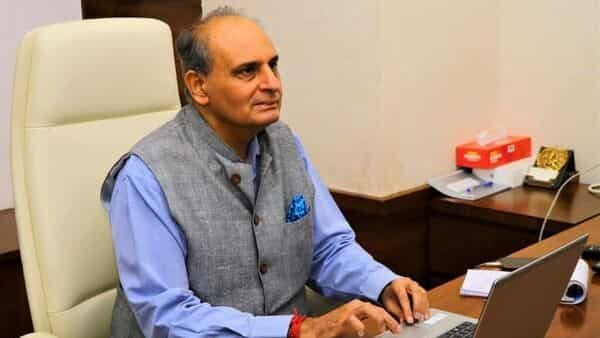

At a time when stock portfolio of a retail investor has been hit badly, Dalal Street observers are buy guessing about the market bottom. Sanjiv Bhasin, Director at IIFL Securities has said that trend reversal on Dalal Street will be soon. While communicating with the Livemint market team, the market expert said that market may bounce back strongly either on Monday or on Tuesday. He said that lowering crude oil prices and US dollar depreciation is expected to provide support to the Indian stock markets and advised positional investors to start taking fresh positions as masrket may rebound any time on Monday or Tuesday session.

Speaking on reasons for expecting trend reversal on Dalal Street, Sanjiv Bhasin of IIFL Securities said, “Nifty and Bank Nifty has corrected more than market has expected and key benchmark indices are in oversold zone. From here downside in Indian indices looks limited and hence, bulls are expected to counter charge when the market opens next week.”

The IIFL Securities expert went on to add that both crude oil prices and US dollar has gone weak. This is also a good sign for India and other emerging markets. he went on to add that there doesn’t seem any trigger that may help US dollar or crude oil prices to regain its lost ground in recent sessions. So, there will be a new market next week and in case market fails to reverse on Monday, there are strong chances of trend reversal on Tuesday. So, any dip on Monday should be seen as buying opportunity by positional investors.

Sanjiv Bhasin said that export oriented stocks have received maximum beating in recent sell off and these stocks are expected to take the lead in expected trend reversal next week.

On 1st December 2022, BSE Sensex climbed to its new life-time high of 63,583 but after that it has been continuously nosediving. On Friday, BSE Sensex finished at 59,845 levels, losing around 3,750 points or 3.50 per cent after hitting new highs. Similarly, Nifty 50 index hit life-time high of 18,887 on 1st December 2022 while it ended at 17,806 on Friday last week, losing over 1,000 points or around 3.50 per cent in this time. However, Bank Nifty remained strong till 14th December 2022 but after the newsbreak of Covid-19 fear, the banking index too failed from its life-time high of 44,151 to 41,668, logging over 5.60 per cent loss in near 10 days.

Disclaimer: The views and recommendations made above are those of individual analysts or broking companies, and not of Mint. We advise investors to check with certified experts before taking any investment decisions.

Know your inner investor

Do you have the nerves of steel or do you get insomniac over your investments? Let’s define your investment approach.

Take the test

Download Finplay News App to get Daily Market Updates.

More

Less