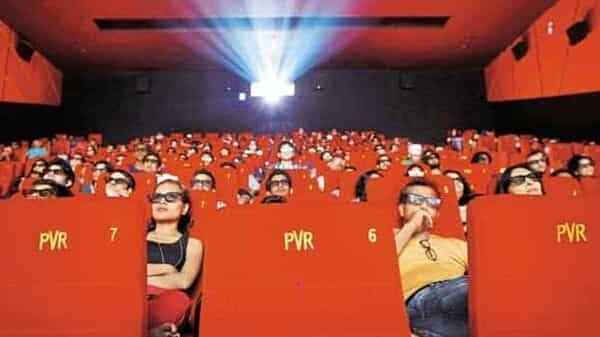

Story takes a turn for PVR, Inox Leisure after a flop Q2

The September quarter (Q2FY23) was a miserable one for multiplex companies PVR Ltd and Inox Leisure Ltd. A few months ago, multiplexes were feeling the heat of the boycott-Bollywood trend on social media as audiences rejected poor movie content. Worries about increased competition from over-the-top (OTT) platforms loomed large.

Given this, Q3 is expected to throw some light on whether consumers’ behaviour has altered meaningfully. The trends in Q3 so far are encouraging with content performance seeing a good rebound in October and November.

Quarter-to-date box office collections for Q3 have already crossed the previous quarter’s collections with a few large movies still lined up for release in December, according to calculations by Emkay Global Financial Services Ltd.

You might also like

What’s driving FIIs’ bullish bets on Nifty

IIT-K student hits record ₹4 cr placement jackpot

How young Indian couples budget for their weddings

In other words, the stage is set for improved financial performance in Q3. “The December quarter was anyway expected to be better sequentially backed by the festive season,” said Jinesh Joshi, an analyst at Prabhudas Lilladher. So far, regional movie content has fared well. Movies such as Ponniyin Selvan: I, Kantara, and Godfather have received a good response.

“Further, with Drishyam 2 clocking upwards of ₹150 crore so far and with Avatar: The Way of Water due for release on 16 December, Q3FY23 is expected to be a good quarter for PVR and Inox Leisure,” Joshi said. As of now, expectations from Avatar are high.

View Full Image

Against this backdrop, occupancy levels of PVR and Inox are expected to improve in Q3. Even so, investors should watch if the momentum in content performance persists. That is paramount and this is where quality of content becomes crucial to consistently attract audiences to movie theatres. Emkay believes that the inflationary scenario and higher ticket prices have raised the cost of movie-going, which has increased content-quality filtration by patrons. “Consequently, footfalls have remained lower that pre-covid levels. The underlying stock price of the exhibitors has also been tracking box office performance,” said Emkay’s analysts in a report on 29 November.

Shares of PVR and Inox are down 14% and 10%, respectively, from their 52-week highs seen in August. Apart from better footfalls and occupancies, a key catalyst for the stocks is the pending completion of the proposed merger of both companies, which is likely to drive synergy benefits. Consistently improving box office collections and better than expected synergy gains after the merger could lead to a re-rating.

Elsewhere in Mint

In Opinion, Himanshu explains the puzzle of vanishing inequality but rising poverty. Ajit Ranade tells how the RBI’s digital currency will help economy. Indira Rajaraman writes on the troubling return of the old pension scheme. Long Story pans the Hindi heartland where Bollywood has gone bust.

Know your inner investor

Do you have the nerves of steel or do you get insomniac over your investments? Let’s define your investment approach.

Take the test

Download Finplay News App to get Daily Market Updates.

More

Less