Temasek Holdings exits PB Fintech for ₹2,425 crore

Bengaluru: Singapore-based global investment firm Temasek Holdings Pte Ltd on Thursday sold its entire stake in PB Fintech, which operates PolicyBazaar and PaisaBazaar, in a transaction valued at ₹2,425.4 crore.

The transaction was executed through a block sale, a person familiar with the matter said.

Temasek, through its entity Claymore Investments (Mauritius), divested 24 million shares of PB Fintech at ₹992.8 per piece, according to BSE block deals data.

While PB Fintech did not immediately respond to Mint’s request for comment, Temasek’s spokesperson said the company does not comment on market speculation and rumours.

Other investors have also booked profits after they sold their stake in the company. Most recently, Japanese investor SoftBank also fully exited its investment in PolicyBazaar’s parent company last month for a total consideration of $650 million on its investment, Business Standard reported citing people familiar with the matter.

It was in 2015 that Info Edge (India) Ltd, an online classifieds firm that was one of the earliest investors in the fintech company, had sold a portion of its shareholding to Temasek for a total consideration of about ₹134.10 crore for a 49.99% stake, according to earlier Mint reports.

The latest development of Temasek’s stake sale comes a day after PB Fintech clocked its first-ever profitable quarter for the three-month period ending 31 December 2023.

The company, which saw its share price cross the initial public offering (IPO) price of ₹980 a share on Wednesday, reported a profit after tax of ₹37.2 crore in the October-December quarter as against a loss of ₹87 crore in the same period a year earlier.

PB Fintech, while delivering strong premium growth amid lower commissions, is expected to grow on the back of its online sales, which grew more than 39% year-on-year in the third quarter of the current fiscal (2023-24). Its revenues also jumped 43% to ₹871 crore in the same period compared to last year.

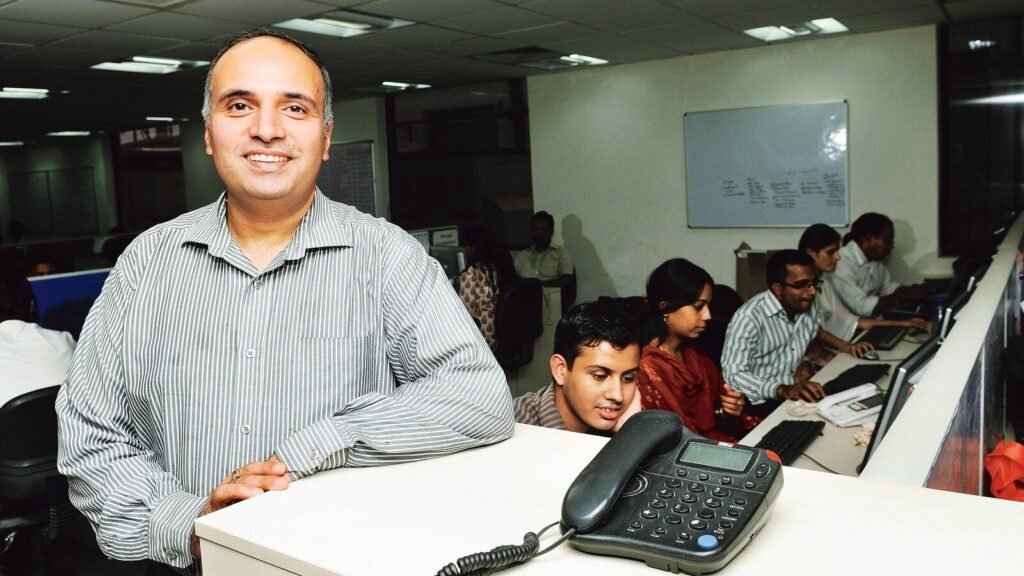

While the company expects its new initiatives division to benefit its bottom line, its core business is likely to drive its growth sustainably, Yashish Dahiya, co-founder and chief executive of PB Fintech had told Mint in an interview earlier this week. New initiatives, which added 33% to its revenues, is a significant part of revenue and growth, he added.

The Reserve Bank of India (RBI) had recently raised risk weights for unsecured loans, but Dahiya said in the interview that it would not hit his business.

“The RBI put out a guidance asking lenders to be more careful on unsecured credit, especially the low ticket unsecured credit below ₹50,000. That is only 5% of our business anyway. And credit itself is 15% of the total revenues, so you can appreciate it’s like 0.6% revenue, right, so it doesn’t bother us too much,” Dahiya said.

The company’s shares closed 0.6% lower at ₹996.9 on BSE on Thursday.

PB Fintech is a leading online platform for insurance and lending products, offering access to insurance, credit and other financial products. In 2021, the company went public and raised ₹5,710-crore, which included selling of shares by existing shareholders.

Here’s your comprehensive 3-minute summary of all the things Finance Minister Nirmala Sitharaman said in her Budget speech: Click to download!

Download Finplay News App to get Daily Market Updates & Live Business News.

More

Less

Published: 01 Feb 2024, 11:51 PM IST