The food spoiler in the inflation game is returning bit by bit

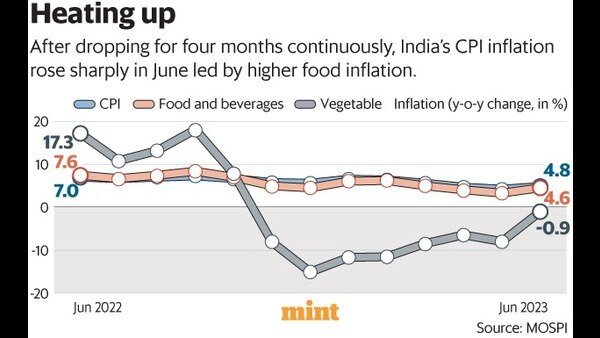

Concerns over inflation have returned after a brief hiatus. Retail or Consumer Price Index (CPI) inflation after easing significantly in the last four months inched higher to 4.8% year-on-year in June from a 25-month low of 4.3% in May. The pick-up is higher than expectations, bringing in some discomfort.

Much of the uptick is attributed to firming food and beverages inflation, which hit a three-month high of 4.6% in June from a benign print of 3.3% in May. While skyrocketing tomato prices are the main culprit, there are other components to be blamed too. Vegetables deflation persisted for the eighth straight month owing to a strong favourable base effect, but at -0.9%, it is fast approaching a turnaround. Besides, inflation remained in double digits for cereals and inched up across most other hea-vyweight food components inc-luding fruits, sugar, spices, and protein basket especially pulses.

To be sure, food inflation spiking in the monsoon months of June to August is neither new nor unexpected. Uneven rainfall distribution adversely impacts crops, impacting food supply. The issue further balloons in the absence of adequate supply-chain infrastructure for perishables, thus stoking prices. But what is more concerning is the significantly higher magnitude of sequential increase in food inflation in June this year compared to the past. This suggests that seasonal price increases across food basket in June is str-ong and it is only favourable base effect that is holding inflation from shooting through the roof.

Adding to this is the further upside risk to the food inflation trajectory emanating from the development of El Niño. As per World Meteorological Organization, El Niño conditions have already developed for the first time in seven years and there is a 90% probability of it continuing during H2 CY2023, thus impacting both global and domestic food supply and price dynamics.

Amid this murk, a contained core inflation trajectory has provided some respite. This reinstates confidence that the aggressive rate hikes by Reserve Bank of India (RBI) since May last year have taken effect on demand side price pressures. But the recent supply side food inflation spike is something that monetary policy has very little control on. The baton, thus, now shifts to fiscal policy in terms of astute supply management, proactive crop buffer controls and prudent food export-import policies. The monetary response to break inflation’s back has been strong in the last one year. Now, it is on the fiscal house to view the spiralling food prices with ‘Arjuna’s eye’ and respond with all arrows in the armour.

Know your inner investor

Do you have the nerves of steel or do you get insomniac over your investments? Let’s define your investment approach.

Take the test

Download Finplay News App to get Daily Market Updates.

More

Less

Updated: 13 Jul 2023, 09:54 PM IST