Titan needs demand more than the residual stake in CaratLane

The Titan Co. Ltd stock was in focus on Tuesday, hitting a new 52-week high of ₹2,893 apiece. According to an Economic Times report, Titan’s buyout of the rest of the stake in CaratLane is facing hurdles. Currently, Titan holds a 72.3% stake in CaratLane. Differences have emerged between the Tata Group and CaratLane founders over the valuation of the residual stake, said the report, citing sources.

In its March quarter earnings call, Titan’s management refrained from giving any insight on acquiring the remaining stake in CaratLane. However, it is unlikely that the residual stake acquisition in CaratLane moves the needle meaningfully for Titan’s near-to-medium term earnings. The potential acquisition of balance stake in CaratLane would be sentimentally positive.

“CaratLane is a good brand under Titan, it has scaled up quite well and is now reasonably profitable too,” said Amnish Aggarwal, head of research at Prabhudas Lilladher. “From the view point of having multiple brands under one roof catering to different segments and sub-segments, it would be helpful/positive if they are able to acquire the full stake in CaratLane,” he added. CaratLane is growing at a fast pace and this trend is likely to persist. In FY23, Titan’s standalone jewellery revenue excluding bullion sales grew by 37% year-on-year (y-o-y) to ₹31,900 crore. CaratLane’s revenues grew by 73% y-o-y to ₹2,200 crore. CaratLane’s Ebit margin rose sharply to 7.6% in FY23 from 4.7% in FY22. As on March end, CaratLane’s total store count is 222. For now, analysts are not ascribing a large value to CaratLane in their valuation estimates. For instance, CaratLane accounts for 6% of Kotak Institutional Equities’ fair value of ₹2,970 apiece based on sum-of-the-parts valuation, as per a May report.

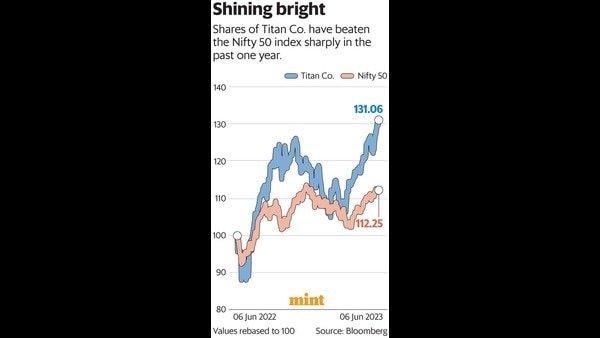

Meanwhile, in the last one year, Titan’s shares have risen by 31%. Valuations are not exactly cheap. The stock trades at 66 times FY24 estimated earnings, Bloomberg data showed. With gold prices scaling new highs in 2023, near-term sales momentum could be hampered as consumers tend to postpone jewellery purchases. Further, competition is a worry. “Competitors such as Malabar Gold and other South-based companies have become aggressive on gold prices. So, the premium that Titan used to charge on gold prices has also come down. In this scenario, incremental earnings growth must be meaningful and currently that does not seem probable,” said Jay Gandhi, analyst at HDFC Securities. “Jewellery margins are at a peak and pricing levers are missing, so revenue growth is likely to be volume-led, but superlative growth is unlikely to come,” he added.

Know your inner investor

Do you have the nerves of steel or do you get insomniac over your investments? Let’s define your investment approach.

Take the test

Download Finplay News App to get Daily Market Updates.

More

Less

Updated: 06 Jun 2023, 09:24 PM IST