What Shankar Sharma’s analysis says on stock market correction

After climbing to life-time high on 1st December 2022, Indian stock market has been under sell off heat and bears have taken full control on Dalal Street. Secondary market sentiments further worsened on 15th December 2022 when new cases of Covid-19 renewed the fear of pandemic once again. This fresh fear of Coronavirus triggered profit booking leading to big fall on Sensex, Nifty and Bank Nifty indices. In fact, the sell off intensified and broad markets too got affected in fresh sell off trigger on 15th December 2022.

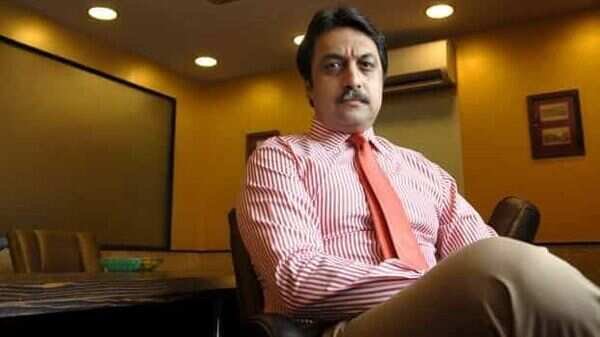

While some stock market experts are expecting trend reversal from Monday or Tuesday next week, ace Indian investor Shankar Sharma has shared his analysis on recent stock market correction. In his analysis of correct sell off, the Czar of small-cap and mid-cap stocks has found that recent correction in small-cap and mid-cap stocks are violent but at the same the same time he reveals that it is routine and one should not get worried much as nothing has broken from fundamental perspective.

Shankar Sharma shared his stock market analysis from his official twitter handle citing, “My analysis tells me that this is nothing but a routine, though violent, correction in mid/ small caps. Nothing is fundamentally broken.”

See Shankar Sharma tweet below:

Replying to a twitter user on small-cap index still at 2018 levels, Shankar Sharma said that the analysis is for stocks and not for index.

On 1st December 2022, BSE Sensex climbed to its new life-time high of 63,583 but after that it has been continuously nosediving. On Friday, BSE Sensex finished at 59,845 levels, losing around 3,750 points or 3.50 per cent after hitting new highs. Similarly, Nifty 50 index hit life-time high of 18,887 on 1st December 2022 while it ended at 17,806 on Friday last week, losing over 1,000 points or around 3.50 per cent in this time.

However, Bank Nifty, small-cap and mid-cap indices remained strong till 14th December 2022 but after the newsbreak of Covid-19 fear, sell off triggered in these indices as well. Bank Nifty failed from its life-time high of 44,151 to 41,668, logging over 5.60 per cent loss in near 10 days while small-cap index has dipped from 29,986 to 27,252 levels, logging over 9 per cent dip in this time. Mid-cap index too shed from 26,393 to 24,426 levels, logging around 7.45 per cent slide in this time horizon.

Disclaimer: The views and recommendations made above are those of individual analysts or broking companies, and not of Mint. We advise investors to check with certified experts before taking any investment decisions.

Know your inner investor

Do you have the nerves of steel or do you get insomniac over your investments? Let’s define your investment approach.

Take the test

Download Finplay News App to get Daily Market Updates.

More

Less

Disclaimer: Along with publishing our own news, we get news from various sources namely from news wires ANI, PTI, other reputed finance portals and individual journalists. We are not legally liable for any inaccuracies in the news and expect the reader to do their own due diligence.