Founded in 1994, ABSLMF emerged from a joint venture between two financial powerhouses: Aditya Birla Capital Limited from India and Sun Life AMC Investments from Canada. This collaboration marked the beginning of a journey that would see ABSLMF not only in mutual funds but also diversifying into portfolio management services, alternative investments, and real estate investments.

As of February 28, 2023, ABSLMF’s Assets Under Management (AUM) impressively stood at Rs 271,747 crore, making up 6.6% of the industry’s total AUM. This substantial figure underlines ABSLMF’s pivotal role and influence in the mutual fund sector.

Diving deeper into its offerings, ABSLMF presents a broad spectrum of 206 mutual fund schemes. This extensive range includes 142 debt schemes, focusing on lower-risk investments; 39 equity schemes, aimed at capital growth; 6 hybrid schemes, blending the characteristics of both equity and debt; and 19 other schemes, which encompass commodities and other specialized investments.

Among its top schemes by AUM are the Aditya Birla Sun Life Liquid Fund, Aditya Birla Sun Life Frontline Equity, and Aditya Birla Sun Life Corporate Bond Fund. Each of these schemes reflects the fund house’s commitment to offering diverse and robust investment options to its clients.

ABSLMF boasts an extensive pan-India presence, operating in over 280 locations across the country. This wide reach ensures accessibility and local support for a vast number of investors, regardless of their location.

Backed by the Aditya Birla Group, a Fortune 500 conglomerate with over 140,000 employees across 100 countries, ABSLMF draws on a legacy of trust, expertise, and global perspective. With 28 years in the industry and managing 79 schemes, ABSLMF stands as a testament to enduring success and innovation in the mutual fund sector.

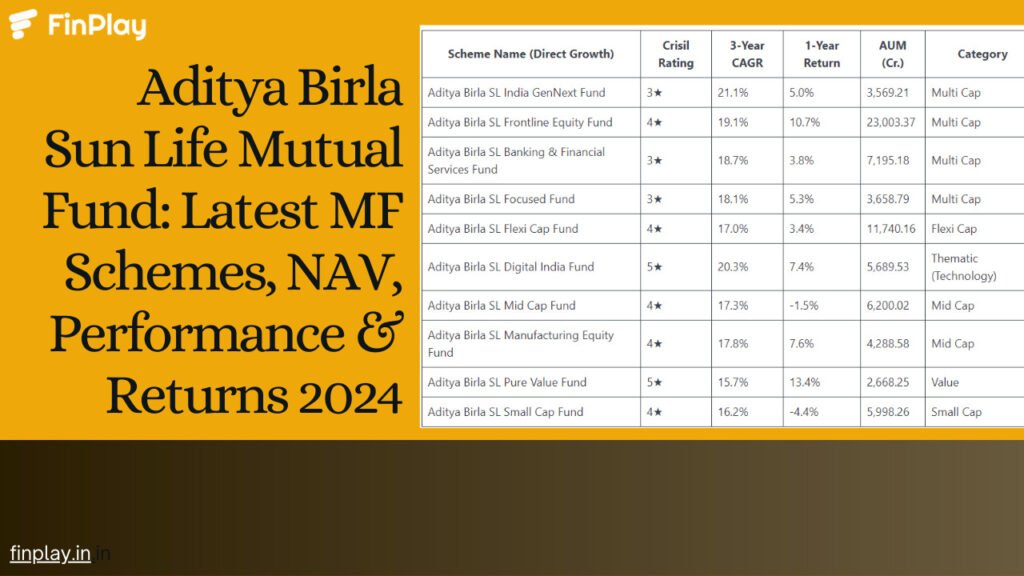

Top Aditya Birla Sun Life Mutual Fund Leading MF Schemes 2024

| Scheme Name (Direct Growth) | Crisil Rating | 3-Year CAGR | 1-Year Return | AUM (Cr.) | Category |

|---|---|---|---|---|---|

| Aditya Birla SL India GenNext Fund | 3★ | 21.1% | 5.0% | 3,569.21 | Multi Cap |

| Aditya Birla SL Frontline Equity Fund | 4★ | 19.1% | 10.7% | 23,003.37 | Multi Cap |

| Aditya Birla SL Banking & Financial Services Fund | 3★ | 18.7% | 3.8% | 7,195.18 | Multi Cap |

| Aditya Birla SL Focused Fund | 3★ | 18.1% | 5.3% | 3,658.79 | Multi Cap |

| Aditya Birla SL Flexi Cap Fund | 4★ | 17.0% | 3.4% | 11,740.16 | Flexi Cap |

| Aditya Birla SL Digital India Fund | 5★ | 20.3% | 7.4% | 5,689.53 | Thematic (Technology) |

| Aditya Birla SL Mid Cap Fund | 4★ | 17.3% | -1.5% | 6,200.02 | Mid Cap |

| Aditya Birla SL Manufacturing Equity Fund | 4★ | 17.8% | 7.6% | 4,288.58 | Mid Cap |

| Aditya Birla SL Pure Value Fund | 5★ | 15.7% | 13.4% | 2,668.25 | Value |

| Aditya Birla SL Small Cap Fund | 4★ | 16.2% | -4.4% | 5,998.26 | Small Cap |

Key information

| Information | Details |

|---|---|

| Mutual fund name | Aditya Birla Sun Life Mutual Fund |

| Asset management company name | Aditya Birla Capital Ltd. & Sun Life (India) Investments Inc. |

| Founded | 23 December 1994 |

| AMC Incorporation Date | 05 September 1994 |

| Sponsor name | Aditya Birla Capital Ltd. & Sun Life AMC Investments Inc. |

| Trustee organisation | Aditya Birla Sun Life Trustee Private Limited |

| Chairman | Kumar Mangalam Birla |

| MD and CEO | A. Balasubramanian |

| Compliance Officer | Ms. Hemanti Wadhwa |

| Investor Service Officer | Keerti Gupta |

Overview of Top Aditya Birla Sun Life Mutual Fund Schemes 2024

Aditya Birla SL India GenNext Fund

The Aditya Birla SL India GenNext Fund, with its 3-year CAGR of 21.1%, is designed for investors who are interested in tapping into the growth potential of companies that are poised to benefit from the changing consumption patterns of the next generation. With a moderate AUM of Rs. 3,569.21 crore, it indicates a focused yet significant interest among investors who are optimistic about the demographic dividend playing out in India’s favor.

Aditya Birla SL Frontline Equity Fund

The Aditya Birla SL Frontline Equity Fund is particularly notable with a 4-star Crisil rating and an impressive AUM of Rs. 23,003.37 crore. It offers a 10.7% return over one year, showcasing its ability to deliver solid performance even in volatile market conditions. This fund is suitable for investors who prefer a stable, well-established fund that spreads its investments across the leading companies of various sectors.

Aditya Birla SL Banking & Financial Services Fund

Investors drawn to the financial sector could look towards the Aditya Birla SL Banking & Financial Services Fund. With an 18.7% 3-year CAGR and a 3.8% return in the last year, it demonstrates the fund’s resilience in a sector that’s central to India’s economic growth. An investment here would be apt for those who have a long-term growth perspective and understand the cyclical nature of financial services.

Aditya Birla SL Focused Fund

The Aditya Birla SL Focused Fund, which concentrates on a limited number of stocks, has managed an 18.1% CAGR over three years. With an AUM of Rs. 3,658.79 crore and a 5.3% return in the past year, it’s tailored for investors looking for a high-conviction approach to equity investment, relying on the fund manager’s expertise to pick potential winners.

Aditya Birla SL Flexi Cap Fund

For a more adaptable investment approach, the Aditya Birla SL Flexi Cap Fund with a 4-star rating might be appealing. It’s designed for investors who seek exposure across various market caps, allowing for strategic shifts based on market trends. With a 17% 3-year CAGR and a 3.4% one-year return, the fund has a sizeable AUM of Rs. 11,740.16 crore, suggesting trust and a robust following among investors.

Aditya Birla SL Digital India Fund

Tech-savvy investors may be drawn to the Aditya Birla SL Digital India Fund, the highest-rated fund with 5 stars by Crisil, which has had a 20.3% CAGR over three years. The 7.4% return in the past year on an AUM of Rs. 5,689.53 crore indicates a strong performance in the rapidly growing digital and technology sector.

Aditya Birla SL Mid Cap Fund

For those with an appetite for taking on more risk for potentially higher returns, the Aditya Birla SL Mid Cap Fund and the Aditya Birla SL Manufacturing Equity Fund target the mid-cap segment, often ripe for growth. While the Mid Cap Fund has experienced a slight setback with a -1.5% return over the last year, the Manufacturing Equity Fund has shown a positive 7.6% return, suggesting sector-specific dynamics at play.

Aditya Birla SL Pure Value Fund

The Aditya Birla SL Pure Value Fund is an interesting choice for value investors. Despite a lower 3-year CAGR of 15.7%, it has posted a remarkable 13.4% return in the last year. With an AUM of Rs. 2,668.25 crore, this fund might appeal to those who are adept at identifying undervalued stocks that have the potential to appreciate over time.

Fund Categories

Top Aditya Birla Sun Life Equity Mutual Fund 2024

| Scheme Name (Direct Growth) | Crisil Rating | 3-Year CAGR | 1-Year Return | AUM (Cr.) | Category | Investment Mandate |

|---|---|---|---|---|---|---|

| Aditya Birla SL India GenNext Fund | 3★ | 21.1% | 5.0% | 3,569.21 | Multi Cap | Invests in companies representing new India’s growth. |

| Aditya Birla SL Frontline Equity Fund | 4★ | 19.1% | 10.7% | 23,003.37 | Multi Cap | Focuses on established blue-chip and large-cap companies. |

| Aditya Birla SL Banking & Financial Services Fund | 3★ | 18.7% | 3.8% | 7,195.18 | Multi Cap | Invests in banking, financial services, and insurance companies. |

| Aditya Birla SL Focused Fund | 3★ | 18.1% | 5.3% | 3,658.79 | Multi Cap | Concentrated portfolio of high-conviction ideas across sectors. |

| Aditya Birla SL Flexi Cap Fund | 4★ | 17.0% | 3.4% | 11,740.16 | Flexi Cap | Invests across market capitalizations based on opportunities. |

| Aditya Birla SL Digital India Fund | 5★ | 20.3% | 7.4% | 5,689.53 | Thematic (Technology) | Targets companies benefiting from India’s digital transformation. |

| Aditya Birla SL Mid Cap Fund | 4★ | 17.3% | -1.5% | 6,200.02 | Mid Cap | Invests in mid-cap companies with high growth potential. |

| Aditya Birla SL Manufacturing Equity Fund | 4★ | 17.8% | 7.6% | 4,288.58 | Mid Cap | Focuses on mid-cap companies in the manufacturing sector. |

| Aditya Birla SL Pure Value Fund | 5★ | 15.7% | 13.4% | 2,668.25 | Value | Invests in undervalued companies with strong fundamentals. |

| Aditya Birla SL Small Cap Fund | 4★ | 16.2% | -4.4% | 5,998.26 | Small Cap | Invests in small-cap companies with high growth potential. |

Top Aditya Birla Sun Life Debt Mutual Fund 2024

| Scheme Name (Direct Plan) | Crisil Rating | Duration | Maturity | 3-Year CAGR | 1-Year Return | AUM (Cr.) | Investment Focus |

|---|---|---|---|---|---|---|---|

| Aditya Birla SL Income Fund | 4★ | Short-term | N/A | 4.8% | 3.5% | 38,298.51 | Fixed Income & Short-term Debt |

| Aditya Birla SL Debt Hybrid Fund | 4★ | Moderate | N/A | 8.6% | 10.6% | 8,008.09 | Equity-Debt Hybrid (Balanced) |

| Aditya Birla SL Short Duration Fund | 3★ | Short-term | N/A | 4.7% | 3.6% | 8,557.10 | Fixed Income & Short-term Debt |

| Aditya Birla SL CRISIL IBX AAA Mar 2024 Index Fund | N/A | Short-term | March 31, 2024 | 6.55% | 6.55% | 1,183.73 | Target Maturity (AAA-rated bonds) |

| Aditya Birla SL Corporate Debt Fund | 3★ | Medium-term | N/A | 7.2% | 8.9% | 1,498.05 | Corporate Debt |

| Aditya Birla SL Credit Risk Fund | 3★ | Long-term | N/A | 8.5% | 12.4% | 1,150.30 | High-Yield Debt |

| Aditya Birla SL Dynamic Bond Fund | 3★ | Flexible | N/A | 6.9% | 9.3% | 3,225.05 | Dynamic Bond |

| Aditya Birla SL Gilt Fund | 4★ | Long-term | N/A | 7.2% | 8.0% | 2,822.23 | Government Securities |

Top Aditya Birla Sun Life Hybrid Mutual Fund 2024

| Scheme Name (Direct Plan) | Crisil Rating | Equity Allocation (%) | 3-Year CAGR | 1-Year Return | AUM (Cr.) | Category | Investment Focus |

|---|---|---|---|---|---|---|---|

| Aditya Birla SL Debt Hybrid Fund | 4★ | 55-70% | 8.6% | 10.6% | 8,008.09 | Balanced Hybrid | Moderate equity & debt mix for capital appreciation & income. |

| Aditya Birla SL Aggressive Hybrid Equity Fund | 4★ | 65-80% | 14.4% | 18.5% | 6,201.42 | Aggressive Hybrid | Higher equity exposure for high potential capital appreciation. |

| Aditya Birla SL Asset Allocation Fund | 4★ | 35-65% | 13.0% | 14.0% | 2,768.65 | Multi Asset Allocation | Dynamic asset allocation across equity, debt, & other asset classes. |

| Aditya Birla SL Equity Savings Fund | 3★ | 30-50% | 10.6% | 10.4% | 6,450.82 | Equity Savings | Lower equity exposure for capital preservation with income generation. |

| Aditya Birla SL Multi Asset Allocation Fund | 4★ | 20-80% | 18.4% | 0.0% | 7,527.56 | Multi Asset Allocation | Flexible asset allocation based on market conditions. |

Top Fund Managers

Mr. Satyabrata Mohanty

Mr. Satyabrata Mohanty is a seasoned professional, having been with Aditya Birla for more than two decades. His specialty lies in mixed assets, where he has shown a knack for identifying companies with strong growth patterns. Under his management, schemes like the Aditya Birla Sun Life Advantage Fund and Aditya Birla Sun Life Dividend Yield Plus Fund have flourished, largely due to his focus on sectors like banking and financial services that are pivotal to India’s growth narrative.

Mr. Maneesh Dangi

Mr. Maneesh Dangi brings a wealth of knowledge to the fixed income space at Aditya Birla Sun Life Mutual Fund. His leadership in managing substantial assets—over Rs. 44,000 Crore across 19 schemes—speaks to his expertise and the trust placed in him by the company and investors alike. His prudent investment decisions have steered funds such as the Aditya Birla Sun Life Corporate Bond Fund to deliver consistent returns.

Mr. Mohit Sharma

Mr. Mohit Sharma, who joined the AMC in 2015, has brought with him a fresh perspective, having had entrepreneurial experience. The funds under his watch have shown over 8% year-on-year returns, making products like the Aditya Birla Sun Life Balanced Advantage Fund and the Aditya Birla Sun Life Low Duration Fund favorable options for those seeking a balance of stability and growth.

Mr. Dhaval Gala

Mr. Dhaval Gala manages the Birla Sun Life Banking & Financial Services Funds and oversees assets close to Rs. 1,900 Crore. His dynamic approach, informed by experiences at renowned financial institutions, has contributed to the success of this sector-specific fund, attracting investors interested in India’s financial sector growth.

Ms. Sunaina da Cunha

Ms. Sunaina da Cunha stands out not only for her tenure since 2004 but also for managing an impressive 13 schemes with an AUM of over Rs. 91,000 Crore. Her funds, such as the Aditya Birla Sun Life Liquid Fund, are often sought after for their liquidity and stability, making them a staple in many investment portfolios.

Mr. Pranay Sinha

Mr. Pranay Sinha, with his rich background from prestigious institutions like IIT and IIM, manages over Rs. 21,500 Crore across 20 schemes. His expertise has led to the development of funds that have not only performed well but have also been a foundation for many investors’ portfolios.

Mr. Kaustabh Gupta

Mr. Kaustabh Gupta has a keen eye for detail, having managed schemes totaling more than Rs. 1.29 Lakh Crore. His experience in treasury and fund management is reflected in the success of schemes like the Aditya Birla Sun Life Government Securities Fund.

Who Should Invest in Aditya Birla Sun Life Hybrid Mutual Fund?

Aditya Birla Sun Life Hybrid Mutual Fund is a type of investment that combines both stocks (equity) and bonds (debt) in a single portfolio. It is designed for investors who are looking to balance the potential for higher returns from stocks with the stability that bonds can provide. This type of fund is particularly suitable for Indian investors who want to participate in the growth potential of the stock market but are cautious about the associated risks and would like some level of protection against market volatility.

Investors who have a moderate risk appetite—meaning they are neither too aggressive nor too conservative—may find this fund appealing. It’s also well-suited for those who are seeking to build their wealth over a medium to long-term horizon. Typically, if you’re saving for goals that are a few years away, like buying a home, funding a child’s education, or planning for retirement, a hybrid fund can be a good fit because it aims to grow your money while keeping the ups and downs in check.

FAQs

How robust is Aditya Birla Sun Life Mutual Fund as an investment choice?

Aditya Birla Sun Life Mutual Fund offers a diverse range of investment options with a solid track record. With schemes like the Aditya Birla SL India GenNext Fund showing a 3-year CAGR of 21.1%, investors have the opportunity to invest in growth-oriented funds managed by experienced professionals.

Which are the top-performing mutual funds from Aditya Birla Sun Life?

The top three mutual funds based on Crisil ratings and performance are:

- Aditya Birla Sun Life Liquid Fund – Direct Plan – Growth (5★)

- Aditya Birla Sun Life Frontline Equity Fund – Direct Plan – Growth (4★)

- Aditya Birla Sun Life Flexi Cap Fund – Regular Plan – Growth (3★)

Is investing in Aditya Birla Sun Life Insurance secure?

As a regulated entity under IRDA, Aditya Birla Sun Life Insurance is considered as reliable as any leading insurance provider in India.

What is Aditya Birla’s rank in terms of leadership and employment?

Aditya Birla Group has received accolades for its leadership, ranking 4th in the world and 1st in Asia Pacific in the ‘Top Companies for Leaders’ study.

Is Aditya Birla Capital a safe and profitable investment?

Aditya Birla Capital has shown strong financial performance, reporting a 44% rise in profit for the quarter ending September 2023, indicating its financial robustness and potential as a good investment.

How to invest in Aditya Birla Sun Life Mutual Funds?

Investors can invest in ABSLMF through the official points of acceptance or online by selecting a scheme, filling out the application form, and submitting the required documents.

Who should invest in Aditya Birla Sun Life Hybrid Mutual Fund?

Those with a moderate risk appetite looking for a balance of growth (from equities) and stability (from debt) over a medium to long-term horizon should consider this fund.

What makes Aditya Birla Sun Life Mutual Fund stand out?

With a comprehensive range of 206 schemes, including equity, debt, hybrid, and specialized investments, ABSLMF offers tailored investment solutions for diverse investor needs.

Who are the key fund managers at Aditya Birla Sun Life Mutual Fund?

Experienced fund managers like Mr. Satyabrata Mohanty, Mr. Maneesh Dangi, and Ms. Sunaina da Cunha have led the fund to manage significant assets with strong returns, showcasing their expertise and successful fund management.

What is the strategy behind Aditya Birla Sun Life Mutual Fund’s scheme selection?

ABSLMF’s strategy involves a mix of rigorous market analysis, economic trend evaluation, and a deep dive into corporate governance practices to select schemes that align with their investment philosophy and investor expectations.